"Since the emergence of Covid-19, mobile networks have been instrumental in providing the reliable connectivity needed to sustain social and economic activities," the GSMA says in its annual report on the state of the mobile economy in the Middle East and North Africa (MENA) region. "As countries bring the pandemic under control, a priority for governments" in the region "and elsewhere is to drive economic recovery and promote sustainable development. Digital services and technologies will be crucial to realizing this objective, by stimulating economic growth, mobilizing the workforce and enabling industrial efficiencies."

The report's key findings include:

- Mobile internet users surpassed 300 million in the region in 2021

- There will be 116 million 5G connections in MENA by 2025

- Mobile operators continue to push ahead with network transformation

- The mobile industry continues to deliver benefits to the economy and wider society

- Policy decisions are fundamental to accelerate MENA's digital future

"The number of mobile internet users in MENA exceeded 300 million in 2021, with penetration due to reach 50% of the population by the end of 2022," the GSMA notes. While the six countries that comprise the Gulf Cooperation Council (Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates) "are home to the highest concentration of mobile internet users ... low take-up rates elsewhere reflect the work that remains to connect offline populations."

What is more, "Smartphone adoption is growing well and is set to increase most strongly in MENA's less advanced mobile markets over the period to 2025, underpinned by continued network investment from operators. Increasing user engagement with bandwidth-hungry applications such as video will lead to a surge in data consumption across the region, growing by 430% between 2021 and 2027."

The GSMA also explains that 4G may be MENA's leading mobile technology with almost 270 connections at the end of 2021 but "4G adoption is projected to peak in 2023 as consumers increasingly migrate to 5G plans." The UK-based organization, which represents the interests of mobile operators worldwide, adds that while "5G remains at a nascent stage" throughout the MENA region, the "current adoption rate of just 1% is expected to grow to 17% by 2025. However, operators in the GCC Arab states are among the global leaders in 5G, with competition and government support triggering launches of some of the world's first and fastest next-generation mobile networks. 5G connections in this part of MENA are set to reach 41 million by 2025 (49% of total connections)."

Investors and companies looking to capitalize on the growth of 5G in MENA will appreciate that "[w]hile the consumer market has been the focus of early 5G deployments, B2B is the largest incremental opportunity in the 5G era, with a raft of digital transformation projects underway across industries. To fully exploit these opportunities, 5G leaders in MENA are investing in new capabilities, with edge computing a priority."

As for the mobile industry delivering benefits to MENA's economy and wider society, the GSMA encouragingly notes that mobile technologies and services generated "5.4% of GDP in the region in 2021 – around $255 billion of economic value added. The mobile ecosystem also supported approximately 890,000 jobs (directly and indirectly) in 2021 and made a substantial contribution to the funding of the public sector, with around $20 billion raised through taxation."

With respect to mobile's contribution to economic growth, in 2021, the report points out that "mobile technologies and services generated 5.4% of GDP in MENA – a contribution that amounted to $255 billion of economic value added. The mobile ecosystem also supported approximately 900,000 jobs (directly and indirectly) and made a substantial contribution to the funding of the public sector, with $20 billion raised through taxation on the sector."

Looking forward, the report says "mobile's contribution to the regional economy will grow by more than $20 billion (approaching $280 billion)" by 2025 "as countries in the region increasingly benefit from the improvements in productivity and efficiency brought about by the increased take-up of mobile services."

As for policy decisions being fundamental to accelerate MENA's digital future, the report says:

In a post-pandemic world, digital connectivity is expected to become even more vital to citizens, firms and institutions alike. Regulatory frameworks that are conducive to investment will be crucial to incentivizing the deployment of telecoms infrastructure. Such infrastructure will be key to economic recovery and future crisis resilience. Seizing the mobile opportunity will require forward-looking spectrum policy, with well-designed assignment spectrum roadmaps, fair prices and technology-neutral licenses needed to support the growth of 5G over the course of this decade and beyond.

Lastly, I support the GSMA's assertion that "[i]t is also more important than ever before to address the barriers to mobile internet adoption and usage in MENA, while data protection regimes must ensure privacy, safety and security for those engaging in the digital economy."

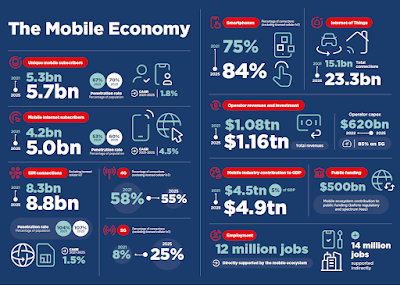

.png) |

| Infographic: GSMA |

With the adoption of the mobile internet continue to rise coupled with investments in 5G, companies worldwide that develop software-as-a-service solutions should consider developing solutions localized for smartphone users in the MENA region. Which mobile solutions do you think consumers or enterprises will utilize in the coming years?

Aaron Rose is a board member, corporate advisor, and co-founder of great companies. He also serves as the editor of GT Perspectives, an online forum focused on turning perspective into opportunity.

.png)